Covr welcomes Russell Graham to the time as part of our SE Asia Expansion

May 8, 2025/by George Fraser

Thank You, Plug and Play Tech Center Sweden

November 29, 2024/by George Fraser

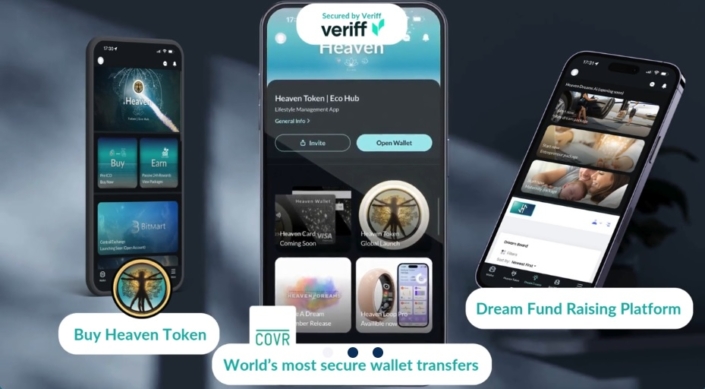

Covr Security to Secure Heaven Token Wallet in Major Partnership

October 4, 2024/by George Fraser

Covr Security and Shush Inc. Announce Strategic Partnership to Enhance Digital Security Solutions

July 16, 2024/by George Fraser

Bangkok Bank Transforms Cash Management Leveraging Covr Multi-Factor Authentication Solution

May 23, 2024/by George Fraser

Enhancing Security in Middle Eastern Payment Platforms: Beyond OTPs to Innovative Solutions

April 24, 2024/by George Fraser

A new era to look forward to in the EU regarding digital wallets

March 18, 2024/by George Fraser

Meet us At LEAP ’24 in Riyadh

February 17, 2024/by George Fraser

What does Dora the Explorer have to do with financial services ?

February 16, 2024/by George Fraser

Join Covr at Intersec 2024 Dubai

January 11, 2024/by George Fraser

Covr Security Secures a Multi-Million Dollar Deal with Major Asian Bank

January 1, 2024/by George Fraser

Covr Announces delivery of project for EU Horizon Programme

December 1, 2023/by George Fraser

Join us at Seamless Saudi Arabia from 4th – 5th September 2023 in Riyadh

August 21, 2023/by George Fraser

A trip into the shadows of cybercrime: the digital deception of regular people.

August 7, 2023/by George Fraser

Can MFA stop fraudsters in their tracks, or will they find a way to beat it?

June 12, 2023/by George Fraser

Real Security for Fintech Enterprises (Including a handy FAQ!)

May 5, 2023/by George Fraser

How to measure your MFA effectiveness – 5 metrics and KPIs.

March 1, 2023/by George Fraser

Digital shoplifting is the new black

November 8, 2022/by Annika Englund

What is the preferred authentication method?

November 8, 2022/by Annika Englund

Who are you? Three simple advice to convince your users of the benefits of MFA

October 18, 2022/by Annika Englund

Why do we keep using bad passwords?

July 18, 2022/by Annika Englund

Different types of identity theft and what to do about it

June 14, 2022/by Annika Englund

Secure Card Payments

January 30, 2022/by Annika Englund

Passwordless web to mobile authentication for payments, money transfers and account security

December 12, 2021/by Annika Englund

Yet another example of why SMS-authentication is a really bad idea!

October 8, 2021/by Annika Englund

Summer greetings with security podcast and well performing partners – Newsletter, June2021

June 15, 2021/by Annika Englund

Open Banking is here to stay – time to make that trouble free transition

June 1, 2021/by Markus Steinwender

The state of digital ID’s

February 12, 2021/by Annika Englund

SYNCH HAR AGERAT LEGAL RÅDGIVARE TILL COVR SECURITY AB

November 27, 2020/by Annika Englund

News and advice from Covr

June 26, 2020/by Annika Englund

Covr Security recognized as a Global CYBERTECH100 2020 company.

June 1, 2020/by Annika Englund

Coronavirus pandemic and cybersecurity — keeping safe in a time of uncertainty

April 16, 2020/by Annika Englund

User-friendly multi-factor authentication with COVR

April 2, 2020/by Annika Englund

Reusable authentication and account recovery

March 8, 2020/by Annika Englund

Covr Security Newsletter March 2020

March 5, 2020/by Annika Englund

Convenience vs. security in mobile banking

February 24, 2020/by Annika Englund

Two major data leaks point to the problems with current security systems

November 26, 2019/by Annika Englund

Covr Newsletter November 2019

November 12, 2019/by Markus Steinwender

Best Fintech Startup

October 11, 2019/by Markus Steinwender

Covr visits Israel to learn from their very active start-up scene

March 7, 2019/by Markus Steinwender

COVR Newsletter – February 2019

February 27, 2019/by Markus Steinwender

Prevent fraud and build trust with your customers by simply buffing up your FDP-system

February 13, 2019/by Markus Steinwender

COVR to pitch during Accelerator Frankfurt’s Demo Day on February 5.

February 4, 2019/by Markus Steinwender

COVR in cooperation in Dubai

January 26, 2019/by Markus Steinwender

Peter Alexanderson is one of the 10 Most Prominent Personalities in the Security Industry, 2018

December 17, 2018/by Markus Steinwender

Market outlook: The need for protection creates explosive growth in the mobile cyber security industry

September 5, 2018/by Markus Steinwender

The best way to handle security threats is simply to prevent them from happening altogether

July 26, 2018/by Markus SteinwenderDo you like our blog? Sign up for our newsletter now!

HEAD OFFICE

Covr Security AB

Nordenskiöldsgatan 24

211 19 Malmö

Sweden

Nordic Locations

Grev Turegatan 3,

114 46 Stockholm

Sweden

Östra Hamngatan 16,

411 09 Göteborg

Sweden

International Locations

470 Ramona Street

Palo Alto, CA 94301

USA

Mindspace Eurotheum,

Neue Mainzer Str. 66-68,

60311 Frankfurt am Main

Germany

80 Robinson Road

#08-01

Singapore 068898

Office #419

Emarat, Atrium Building

Sheikh Zayed RD, Dubai

UAE